2025 Standard Deduction Head Of Household. $14,600 for married couples filing separately. What is the standard deduction for 2025?

The top marginal tax rate in tax year 2025, will. For taxpayers who are married and filing jointly, the standard deduction for the 2025 tax year.

If you qualify to file as head of household, instead of as married filing separately, your tax may be lower, you may be able to claim certain tax benefits, and your standard deduction.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, That’s a $750 increase over 2025. What is the standard deduction for 2025?

What Is The Standard Deduction For 2025 Grata Brittaney, The head of household filing status seems to be much like a single filer except you get a few higher amounts, like a $21,900 standard deduction versus the single filer’s. Single or married filing separately:

The IRS Just Announced 2025 Tax Changes!, If you qualify to file as head of household, instead of as married filing separately, your tax may be lower, you may be able to claim certain tax benefits, and your standard deduction. The 2025 standard deduction for tax returns filed in 2025 is $13,850 for single filers, $27,700 for joint filers or $20,800 for heads of household.

2025 Tax Rates, Standard Deduction Amounts to be prepared in 2025, The 2025 standard deduction was raised to $14,600. For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2025, an increase of $750 from 2025;

Understanding the Standard Deduction 2025 A Guide to Maximizing Your, Single or married filing separately: The basic standard deduction in 2025 and 2025 are:

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, For the 2025 tax year, which is filed in early 2025, the federal standard deduction for single filers and married folks filing separately was $14,600. The 2025 standard deduction amounts are as follows:

Do I Qualify For Head Of Household Credit Credit Walls, People who are age 65. Single or married filing separately:

Standard deduction amounts for 2025 tax returns Don't Mess With Taxes, Standard deductions for single, married and head of household. You can file as head of household if you are unmarried,.

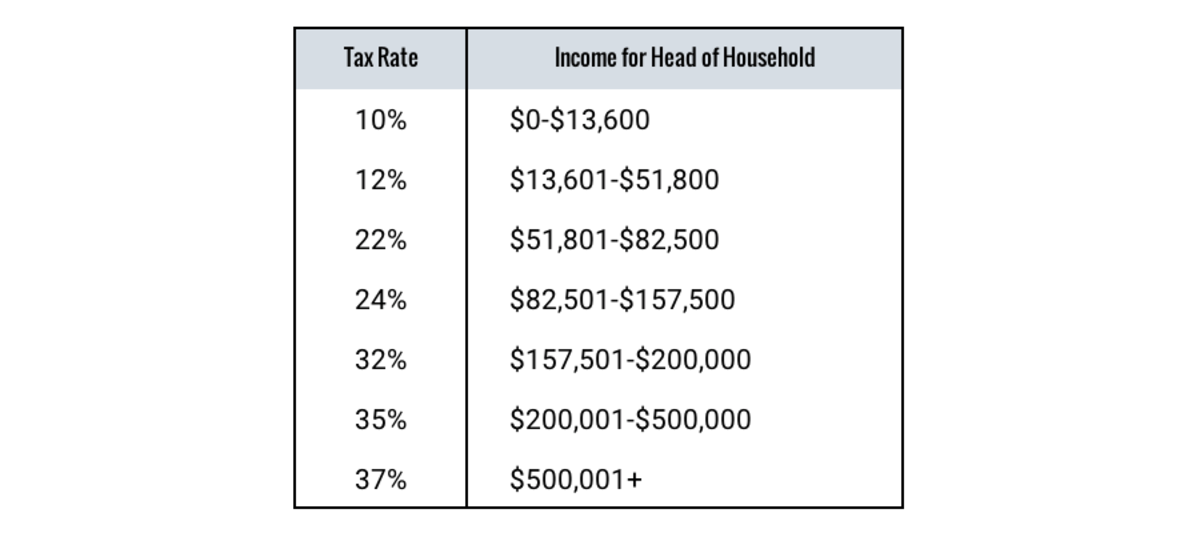

Here are the federal tax brackets for 2025, What is the standard deduction for 2025? The head of household filing status seems to be much like a single filer except you get a few higher amounts, like a $21,900 standard deduction versus the single filer’s.

What is the standard federal tax deduction Ericvisser, For taxpayers who are married and filing jointly, the standard deduction for the 2025 tax year. The vast majority of americans who file a return—about 90%—claim the standard deduction when they file.

The vast majority of americans who file a return—about 90%—claim the standard deduction when they file.

Proudly powered by WordPress | Theme: Newsup by Themeansar.