401k Contribution Limits 2025. If you really want to boost your savings, you might even contribute the maximum to the account. The 2025 contribution limits for.

The 2025 401 (k) contribution limit for employees was $22,500. 401 (k) pretax limit increases to $23,000.

The roth 401 (k) contribution limit for 2025 is $23,000 for employee contributions and $69,000 total for both employee and employer contributions.

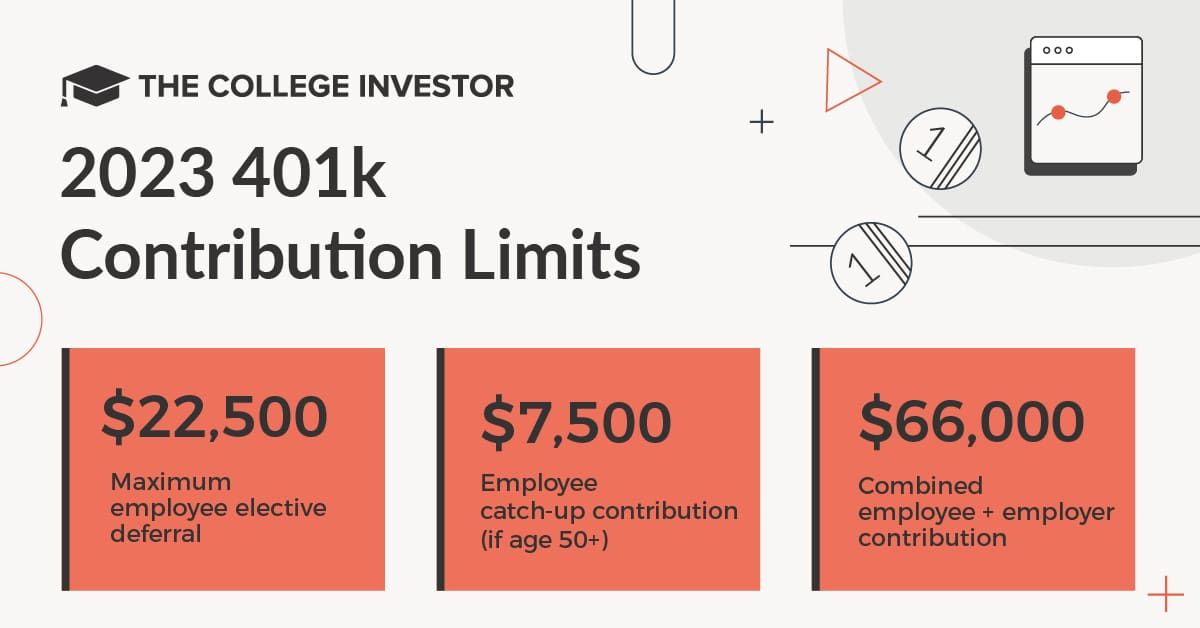

Employee 401 (k) contributions are capped at $22,500 in 2025 and $23,000 in 2025, with higher total limits including employer.

What’s the Maximum 401k Contribution Limit in 2025? MintLife Blog, The increased contribution limits automatically apply for employers with no more than 25 employees who earned $5,000 or more for the previous year, regardless. The 2025 401 (k) contribution limit for employees was $22,500.

2025 IRS 401k IRA Contribution Limits Darrow Wealth Management, People under age 50 can generally contribute up to $23,000 per year to their 401 (k) plans, while those age 50. The 401 (k) contribution limit for 2025 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions.

401(k) Contribution Limits in 2025 Meld Financial, 401 (k) contribution limits for 2025. The 401 (k) contribution limit for individuals has been increased to $23,000 for 2025.

40 Passive Revenue Concepts For 2025 To Construct Actual Wealth https, 401 (k) contribution limits in 2025 and 2025. Washington — the internal revenue service announced today that the amount individuals can contribute to their 401 (k) plans in 2025 has increased to $23,000, up.

401k Maximum Contribution Limit Finally Increases For 2019, For those with a 401 (k), 403 (b), or 457 plan through an employer, your new maximum contribution limit will go up to $23,000 in 2025. The 2025 401 (k) and 403 (b) employee contribution limit will increase to $23,000 for those under 50.

self directed 401k contribution limits 2025 Choosing Your Gold IRA, People under age 50 can generally contribute up to $23,000 per year to their 401 (k) plans, while those age 50. 401 (k) limit increases to $23,000 for 2025, ira limit rises to $7,000.

The Big List of 401k FAQs for 2025 Workest, This year, defined contribution plans got a historic contribution limit. 401 (k) contribution limits in 2025 and 2025.

Significant HSA Contribution Limit Increase for 2025, People under age 50 can generally contribute up to $23,000 per year to their 401 (k) plans, while those age 50. 401 (k) contribution limits in 2025 meld financial, the roth 401 (k) contribution limit for 2025 is $23,000 for employee contributions and $69,000 total for both employee and.

What Is The Ira Contribution Limit For 2025 a2022c, Washington — the internal revenue service announced today that the amount individuals can contribute to their 401 (k) plans in 2025 has increased to $23,000, up. The 2025 401 (k) contribution limit for employees was $22,500.

self directed ira contribution limits 2025 Choosing Your Gold IRA, This year, retirement savers may put up to $7,000 in a roth ira (or. The 401 (k) contribution limit for 2025 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions.