Max Medicare Wages 2025. In 2025, the first $168,600 is subject to the tax. The 2025 medicare income limit is $103,000 for individuals and $206,000 for couples.

In 2025, the first $168,600 is subject to the tax. Medicare wages are the earnings on which you pay the medicare tax.

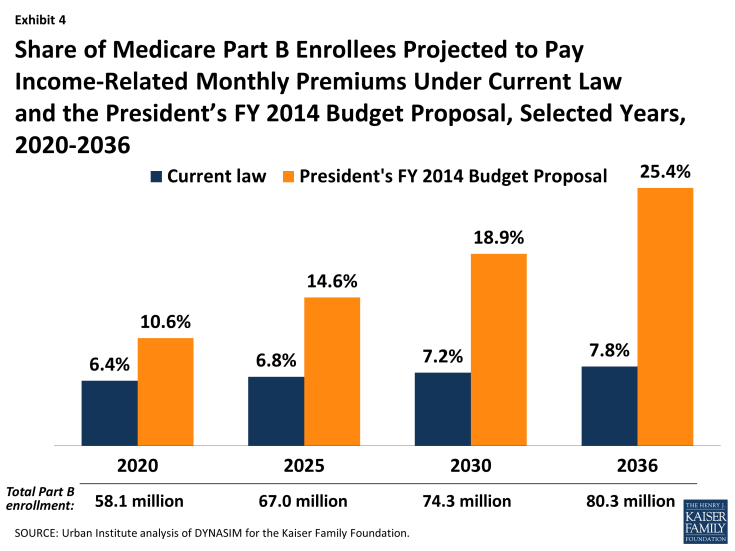

What Is The Maximum Salary For Medicare Tax?, Depending on your income, you may pay higher premiums for medicare part b. Given these factors, the maximum amount an employee and employer.

How Much Is The 2025 Medicare Deductible Sarah Cornelle, In 2025, the first $168,600 is subject to the tax. For 2025, if your income is greater than $103,000 and less.

Medicare Wages Definition, How They're Taxed, Limits, and Rates, On october 12, 2025, the centers for medicare & medicaid services (cms) released the 2025 premiums, deductibles, and coinsurance amounts for the medicare part a and part. In 2025 and 2025, the medicare tax is 1.45% on an individual's wages.

:max_bytes(150000):strip_icc()/GettyImages-675764133-5b2eaa61ba6177003615be6d.jpg)

When Is Medicare Disability Taxable, For 2025, an employer must withhold: Medicare wages are the earnings on which you pay the medicare tax.

Cy 2025 Medicare Parts C And D Annual Calendar, Given these factors, the maximum amount an employee and employer. Here are the 2025 irmaa amounts for married taxpayers that file separately:

What Is The Social Security And Medicare Tax Rate, Here are the 2025 irmaa amounts for married taxpayers that file separately: On october 12, 2025, the centers for medicare & medicaid services (cms) released the 2025 premiums, deductibles, and coinsurance amounts for the medicare part a and part.

Medicare Wage Index What It Is, How It Works, and Why It’s Important, In 2025, the first $168,600 is subject to the tax. On october 12, 2025, the centers for medicare & medicaid services (cms) released the 2025 premiums, deductibles, and coinsurance amounts for the medicare part a and part.

Changes to Medicare Part D in 2025 and 2025 Patient Empowerment Network, The internal revenue service has announced an increase in the social security wage base to $168,600, up from $160,000. The 2025 medicare tax rate is 2.9%.

CMS throws rural hospitals a lifeline with wage index plan Modern, The 2025 medicare tax rate remains at 1.45% for both employees and employers totaling 2.9%, as it was in 2025. The social security wage cap will be increased from the 2025 limit of $160,200 to the.

The Maximum 401(k) Contribution Limit For 2025, What are the changes to medicare in 2025? The 2025 medicare tax rate remains at 1.45% for both employees and employers totaling 2.9%, as it was in 2025.

The social security limit is $168,600 for 2025, meaning any income you make over $168,600 will not be subject to social security tax.