Texas Property Tax Protest Deadline 2025. As per section 41.44 of texas property tax code, the deadline for filing a property tax protest in texas is may 15th, or 30 days after the notice of value was delivered to the property owner, whichever is later. By 2025, we can expect further.

A deal on property tax relief was reached during the second special session with two bills and a joint resolution signed into law by gov. For homestead properties, the early protest deadline is april 30th or 30 days after the date the appraisal district sends a notice of appraised value, whichever is later.

Texas Property Tax Protests Attorneys Wharton Matagorda Richmond TX, New limitations on property tax rate.

Texas Property Tax Protest Deadline 2025 Inna Renata, In most cases, the deadline to file property tax protests is may 15, or 30 days after they receive the appraisal notice to file an appeal.

Property Tax Protest in Texas 2025 YouTube, Under senate bill 2 and senate bill 3, $18 billion of texas' historic budget surplus will be allocated toward driving down school district property tax rates, increasing homestead.

DIY Property Tax Protest Webinar Watch Here! 📼 Land Sale TX, There are a few instances where homeowners can file a.

Tarrant County Property Tax Protest Deadline 2025 Lara Sharai, When are my property taxes due?

Property Tax Protest Travis County, This calendar shows important property tax deadlines for appraisal districts, taxing units and property owners.

How to Protest Property Tax in Texas & Win in 2025 With Bezit, If you choose to protest the value of your property, you can.

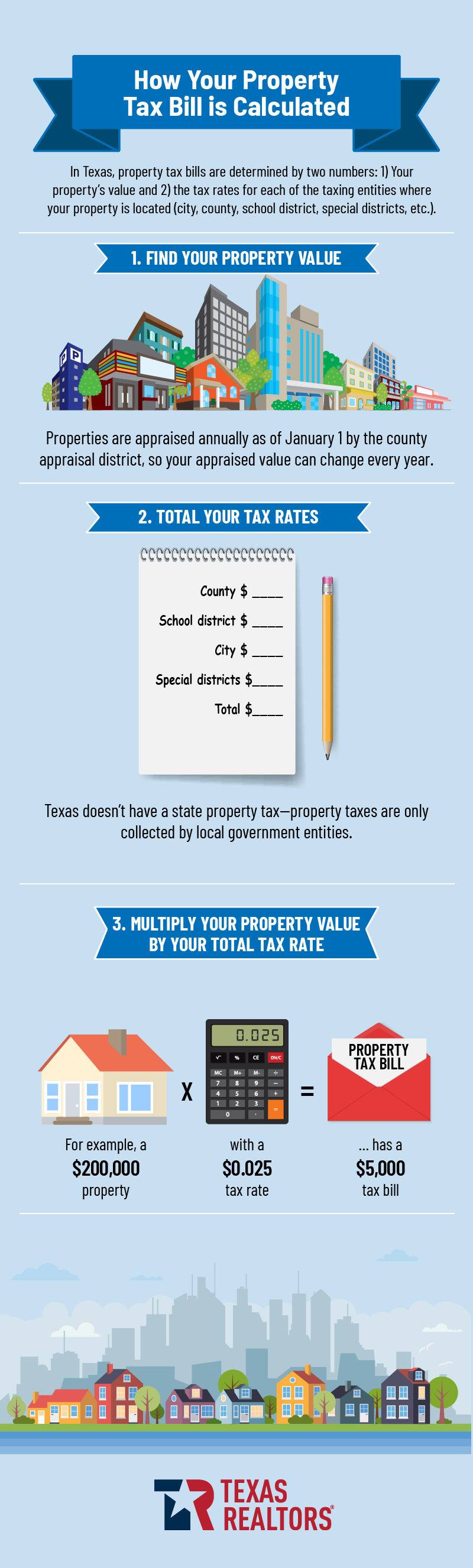

Property Tax & Protest information, Texas homeowners have the right to protest their property taxes when they disagree with the county’s taxable value assessment.

Tips on Property Tax Protests in Texas Frisco Tax Prep, On july 22, 2025 the internal revenue service announced tax relief for individuals and businesses in 67 texas counties affected by hurricane beryl that began on july 5, 2025.